Aftermath Silver – Expanding And Derisking Silver, Copper, and Manganese Mineralization At The Berenguela Project

Michael Williams, Founder and Executive Chairman of Aftermath Silver Ltd. (TSXV: AAG) (OTCQB: AAGFF), joins me to introduce the vision behind this exploration company focused on expanding and derisking the silver, copper, and manganese mineralization at their flagship Berenguela Project in Peru, and secondary Challacollo Silver-Gold Project in Chile.

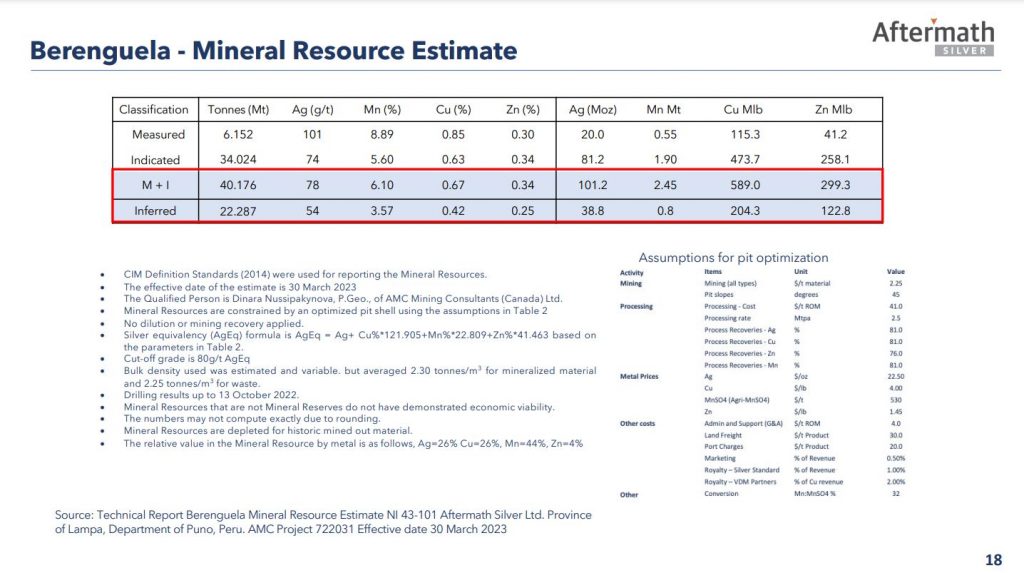

We start of diving into the asset and polymetallic silver, copper, and manganese components contained in the current resources in both the Measured and Indicated as well as Inferred mineral categories. We then get into the nuances as far as how the processing would be envisioned producing silver dore, copper cathodes, and then high-purity manganese crystallization as end products. This ties into their infrastructure advantages being near both road and rail at the Project.

The company is currently drilling to increase confidence in the mineralization and move some of it up in categories from inferred into indicated in the upcoming resource estimate update slated for Q1 of 2025. The next key milestone after that will be the Preliminary Economic Assessment (PEA) slated for later next year, where it will incorporate economics around all the metallurgical testing, mine planning, and updated resources. We also discuss the experience and bench strength of the management team and board, as well as the key strategic shareholder in Eric Sprott.

If you have any questions for Michael regarding Aftermath Silver, then please email them in to me at Shad@kereport.com, and we’ll get them answered directly, or in future interviews.

.

Click here to follow the latest news from Aftermath Silver

.

.

You know Wolfster Nvidia is a heartbeat away from having a market cap of $4Trillion, it is up again today, and the market cap is now $3Trillion 650 billion. With Trump in and the markets moving higher I can see that happening soon. But the higher they go the more they correct, and they always move much faster on the downswing, this will be a moment in History when people will say “What were they thinking”. The herd is blind it’s like Nortel Networks when the tech boom was on over 30 years ago, the elevator couldn’t stop going down even if you pressed all the buttons on the floors. LOL! I must admit I find it all amusing.

It was all so easy. The gateway to fortune stood wide open, all you have to do is buy Nvidia stock just like your neighbor. Nvidia’s stock price has hit a permanently high plateau. LOL! LOL! and LOL! Again DT 🤣😉

Wolfster, Trudeau is trying to introduce a digital ID for the public that should make the hackers smile! DT

Saw your comments Matthew. 👍

Just a little frustrating that 4-5 up days go poof in one big drop or even worse but it seems like eons since we had one of those huge up days.

The copper yo yo continues. I still lean towards eventual return to $5+ in 2025

DT. I get Nvidia valuation seems outlandish but I for one have no clue what the potential future earnings are so I don’t comment on it’s valuation

Trump in. PP next DT. 🤞